The History of WSB

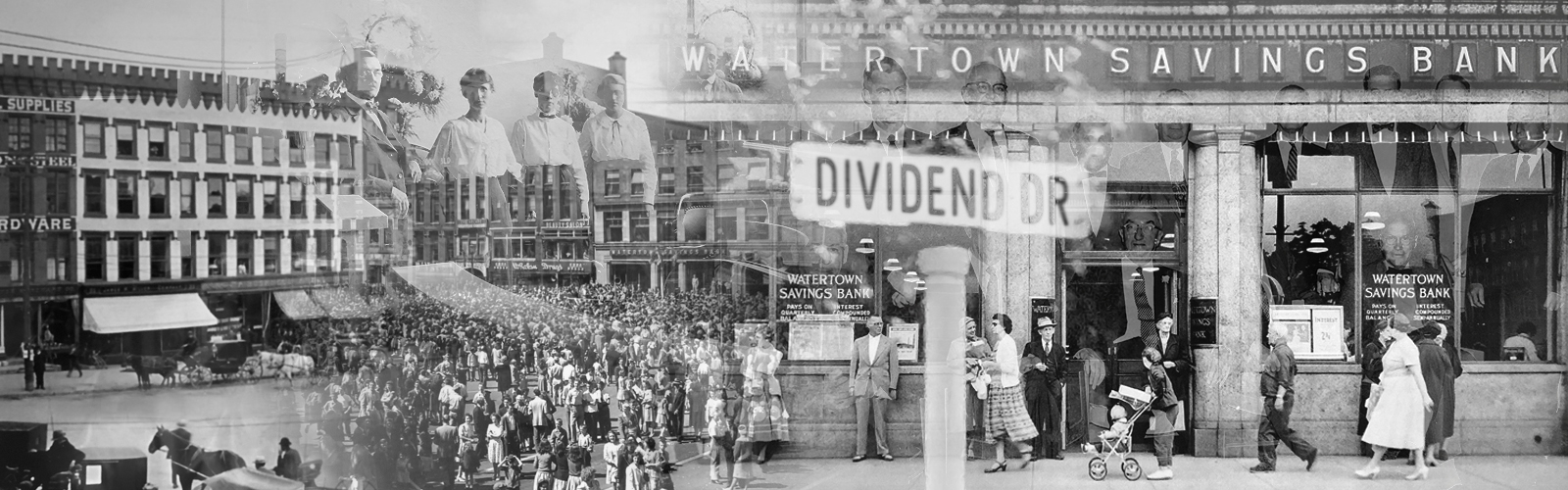

2018 marked the 125th anniversary of Watertown Savings Bank. We're very proud of that milestone. For a local business, that is a very long time to not only endure, but prosper. We have the same name and mission statement today as we did when our doors first opened in 1893.

We invite you to take a journey back in time with us. A historical look at, not only WSB, but the individuals who helped shape our community's path to what we know today.

WSB Officers

|

Mark R. Lavarnway Mark S. Bellinger Scott M. Pooler Amy S. Moore Heather A. Makuch Terri J. Erdner |

President & Chief Executive Officer Executive Vice President & Chief Operating Officer Executive Vice President & Chief Information Officer Executive Vice President & Chief Financial Officer Executive Vice President, Deposit Operations Executive Vice President, Branch Administration |

Board of Trustees

Mark S. Bellinger Denise P. Brownell Bradley T. Clark Steven J. Hall Mark R. Lavarnway Richard E. Poulsen Robert J. Sharlow Michael D. Yonkovig |

Trustees Emeriti

Louis B. Adams, Jr. Nicholas J. Buduson Donald L. Calarco Franklin D. Cean Dr. John W. Deans Mary A. Jareo F. Anthony Keating Joseph L. Rich |